What is the ban on cryptocurrency mean?

The panel set up by the interministerial committee of the government submitted it’s reporting on virtual currencies. It has proposed the banning of private cryptocurrencies by imposing fines, and penalties for trading activities based on cryptocurrencies. Publically the reasons for the ban have been stated as

- Highly risky and volatile for investors

- Easy usage for illicit purposes

There arises a question in everyone’s mind If it is a risky proposition

- why can’t any government leave it in the hands of investors to face the risk of the market?

- Why impose a ban?

Traditionally stock marketers were in the habit of making quick bugs. It has been kept in check by the agencies of government and central monetary institutions like RBI in India. But such stocks are backed by physical assets in the form of a company. Private cryptocurrencies being a virtually generated money stands in conflict with government-backed fiat currencies. So, it is imperative to understand the functions of a central organization like RBI to gain a better understanding of the real potential of technology.

Functions of RBI:

- Printing the currencies of a sovereign nation.

- Minimizing the risk of fluctuations in the currency market.

For a currency issued by a sovereign state like India, it is often backed by a central monetary authority like RBI in India. What does the backing refer to? It offers the value for its own people to carry out transactions. This value is backed by the law of the land to recognize the printed material as a medium for purchase and selling of goods.

Essential Functions of Money:

- sovereignty claims help in legal tenders. Eg land transactions are often done with currencies backed by legal agreements

- Foreign Exchange – Currencies value are determined by standards like a basket of foreign currencies, gold or silver commodities

- Fixed nominal value. Eg. A 5 rupee note has its value backed by its printed agency.

Family Analogy:

Initially, on raising a family, a father and a mother grew up in a different environment. So with the mindset of raising a family, they got involved in daily affairs of bringing up their child. During their time it’s cash everywhere, which is a physical asset. When a property is backed by an institution refers to be physical in nature. In the case of currency or hard cash, it was a central authority like RBI. It controls the amount of money being supplied to the hands of any individual.

The intermediaries like banks supply this printed money acting between Central monetary agency and end-user. The head of the family earns every penny hard by working. Eventually, they raised their kids and got old fashioned. They got attached to their physical assets of properties like land and house. These were referred to mortgages purchased from their hard-earned currency.

Though central banks carry out activities of printing money it is supplied to end-user by intermediaries like banks. The entire logistics of handling cash becomes a long driven process. Any interventions minimizing this task considered to be established as an innovation in the financial industry.

Later, came the inventions of plastic money in the form of electronic numbers. It makes a smooth transition of allaying initial fears of a new kind of currency. It enables individuals to switch between hard cash in hand to plastic cards in their wallets.

As the kid grows up, the plastic money gets registered in the form of digital payments. The digital revolution enables financial transactions to happen through the internet. Many private enterprises started exploring these changes in the currency market to offer payment services. It offers multiple choices to the users by providing various payment platforms like

- Debit or credit card

- Netbanking

- Mobile wallets.

- Cash on delivery.

Such changes in the money market clearly showed that the essential nature of money is to be a liquid asset. It means people use the money for various buying and selling activities of goods as well as services.

As soon as crypto becomes a worldwide phenomenon, the fatherly attitude caught up. A father being head of the family got more attached to his assets rather knowing changes in the market. He also owns the responsibility in protecting his own family.

As they say, more power means more responsibility, in the name of protecting one’s own family, the father got stuck in changes happening worldwide. So the government could not able to find essential attributes in the normal currency to cryptocurrency. It is none other than a mindset issue for those holding the big fat chair of authority

Moreover, the ban in India has been accrued to reasons

- rising trade across borders using cryptocurrency.

It is a realized fact that going after the digital economy eventually paves the way for virtual currency. This next-gen platform tends to be highly liquid and easily convertible. As we all know Rome is not built in a day, the statistics align in favor of modern modes of transaction.

The cryptocurrency tends to solve the mystery of why a central authority cannot decide on putting money in one’s own pocket.

Centralization of currency:

The course of putting money in everyone’s hand is decided by some authority holding a big fat check in his pocket. This contradiction in currency environment holds grip to common man in the streets. But a large section of the population was busy in carrying out their daily routines.

But over a course of time, it has been found that the cash in the domestic economy is increasing at a rapid pace. Some experts suggest that the cash is growing at a rate of 14% of GDP. This is just an indicator of the amount of economic activity taking place in the local economy. What does this mean?

- The political campaign being carried out in hoarded cash

- The popping of black markets in every sector- hoarding cash

- shady transactions in business like real estate

- corruption in administrations across various government and private departments

These are few to name multiple lethalities associated with cash. Such activities tend to raise inflation giving hard times for a legitimate earning of income-oriented persons. Many of the T.V room discussions hover around the blame of inflations impacting every common person in the street.

This blame often tends to be put on the government for mismanaging its own economy. As the entire machinery of government and bigger corporations revolves around managing their finances to pay their employees and concerned staff members.

Rome is not built in a day

It requires a great depression to understand the faults in the financial system. There were massive bailouts of financial institutions. To avoid the failiure of large banks, the government started printing more money. It faces the heat of shutting down governments functionaries in many developed economies like the U.S and Europe.

A similar situation has been witnessed in India due to the unearthing of non-performing assets called NPA’s. It means lending of loans by banks has turned to be unproductive. The repayment to banks by a business does not happen for a long period of time. While many business magnets found to be involved in such a crisis they started absconding abroad. It is nothing but the harsh reality of handling cash where people started exploiting the loopholes in the system.

The crisis runs deep into the financial system of the country claiming to have a toll on every legitimate taxpayer. For quite sometime media has been making noises by naming and shaming individuals like Vijay Mallya and Nirav Modi.

But for public as a whole, it is found to be media entertainment at best, a tea bench gossip to be discussed. Soon the situation has been normalized by keeping it under the carpet.

Now, such white-collar frauds have been considered as a serious offense by nations investigating agency like CBI. Traditionally been considered as an investigation authority acquired its modern color by hiring banking personnel. So that such fraudulent claims are put under a check to channelize the money into its legitimate use. This proves, no system of any government is foolproof in itself with open exploitation.

As a recourse mechanism to such fraudulent practices digital payments come in handy for many of the financial services likes banks. Now experts claim that cash to GDP ratio: reduced from 12 to 9% over a short span of 6 years. Low-cost digital modes of payments are operational to register growth in the number of users in

- UPI – 754 million,

- IMPS – 171 million and

- NETC – 26 mn

Cash to cashless:

Slowly the effects of hard cash have been kept at check by expanding the digital economy. But the growth of cash never stopped hovering about 14% of GDP as mentioned by experts. With a major push of demonetization move by the government, the impact of the reduction in the hoarding of cash is realized.

plastic currency

As mentioned above the largest machinery of economic activities is carried by the government. So change in its thinking could able to give rise to a new form of opportunities.

Indicators of rising digital transactions:

- More point of sale machines

- Increased credit card and debit card transactions

- The rise in mobile payments

Then the growth of digital transactions has given rise to new opportunities. Transacting through mobile platforms shows an upward trend. It provides a new payment landscape whereby many private participants like mobikwik, phone pay, paytm offers a payment platform. With the change in trend government also came up with BHIM app powered by NPCI. Nowadays many services of government machinery are being partnered to get digitized.

Once such transactions have been considered panacea, now turns into a real picture. These digital technologies are bringing down the administrative cost of operating business. Government and private corporations started setting targets to achieve increasing digital transactions thereby turning into digital as new normal.

As the internet users grow, the management of data finds its potential in managing the risk of financial business. In 2008 the global financial crisis finds that there has been a case of failure in credit rating agencies.

These are financial services offered to know the real value of money to a business. Such a rating is found to be essential for banks for lending purposes.

The failure of massive mortgages by an artificial spike of its value is cited as one of the major reason for depression. To overcome such services of credit rating agencies, major financial institutions like world bank started investing in big data. The idea has been that these rating services are being automated by big data systems based on enterprises transactions.

The individual enterprises and business are tracked for their real potential in doing business. Thus the potential of going digital in major financial institutions like world bank and IMF is started finding its own way.

As the internet users grow, the data stands at the center point in driving their major decisions. Thereby avoiding any risk of finding the actual value of any business. Any company getting money from the banks are monitored. Thus loan repayments are kept at check without the need for third-party rating services.

These large institutions recognize the changes after undergoing deep depressions. It is by their sheer size that the changes took time to get implemented. So is the result of changes in adopting a different model of the payments system.

Cashless to No cash

Blockchain technology

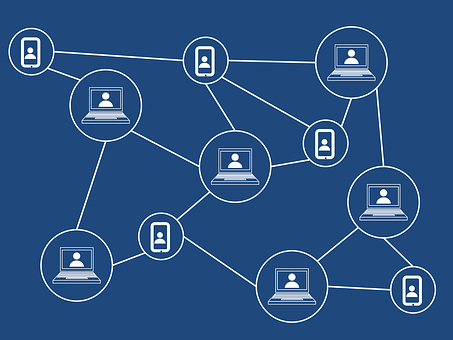

After digital, the buss word has been virtual, which witnessed the rise of 2153 virtual currencies that have been in circulation. It is a decentralized form of currency with no central authority to control the transaction. The payments are made across the world in no matter of time.

It is essential to understand the decentralization concept against the centralized transfer of money being done from tax.what happens during the transfer of money from one bank account to others?

The request will be sent to the bank’s central server which recognizes any account requesting the transfer of money. Then it processes the amount by transferring from one concerned bank to various utilities like telephone bills or any other services.

The information got recorded in the server, by maintaining a digitized ledger on its own. In order to keep the economy running, banks spend a large capital for managing its infrastructure. Since all banks operate in a network mode, their IT backbone is crucial for carrying out its business.

In the future, the distributed ledger technology or blockchain is predicted to revolutionize this mode of data record-keeping mechanism. Let’s explore this by understanding crypto-currency which also operates in a similar technology platform.

Cryptocurrency

In the case of crypto-currency, it is a 3-way process.

- Mining

- storing

- Transacting

So why the cryptocurrency holds potential for no cash economy?

Comparative advantage :

- The digital environment,

- No cost transactions

- The transaction to locals vs global

- Lightening fast transaction in large volume – Operational across the world

So why the cryptocurrency holds potential for no cash economy?

The cryptocurrency uses blockchain technology to carry out virtual transactions. These transactions are made across the globe, making virtual currency to be hardly fit in a regulatory environment of a particular geography.

Once both parties, sender, and receiver agree to make the transaction, like bitcoin they obtain a cryptic code. It tends to unlock the money without any necessity of a central servers response. Such transactions are totally anonymous and considered highly secure. Only the agreed parties tend to know the information on transactions. As the transactions happen within their network it is considered to be lightning fast. Thus buying and selling of different virtual currencies is carried out on a peer to peer basis.

When compared to other cryptos, bitcoin is the earliest found currency. So naturally, the transaction volume is found to be high. Similarly, there are other currencies like ethereum, litecoin etc., So no authority fixes its value, which gives its other name as speculative currency.

This tends to replace the hard logistics of hard cash. The transfer of money from its printed area to distribution channels across banks takes place only within a country’s geography. The mined virtual currency offers a competitive edge to transfer across borders in lightening speed.

By considering such a wide scope, it is imperative to have an open mind about the virtual currency. As this generation has witnessed the digital revolution, the future takes a leap in the form of virtual currency. While no cash economy cannot be a reality in the near future, tech innovation in the financial sector provides an interesting landscape to be explored.

Recent Comments